14 Types of Healthcare Contracts and their Management

Table of contents

- Types of healthcare contracts

- Data privacy and compliance in healthcare contracting

- How to manage medical contracts more securely

-

About Concord

Effortless contract management, from drafting to e-signing and beyond. Book a live demo to see Concord in action.

Request demo

The healthcare industry has one of the largest and most complex paperwork loads of any sector. A substantial portion of that paperwork doesn’t have anything to do with medical information. Instead, it has to do with contract management for healthcare agreements and other types of legal documents.

Types of healthcare contracts

Hospitals, clinics, and other health providers deal with a wide range of important legal documents, many of which are good candidates for contract automation.

The most common types of contracts and agreements in healthcare are:

- Physician employment contracts

- Physician recruitment contracts

- Management services arrangements

- Medical directorship arrangements

- Transfer agreements

- Technology licensing agreements

- Executive compensation and employee benefit arrangements

- Joint venture agreements

- Purchased service agreements

- Under-arrangement agreements

- Real estate agreements

- Equipment sales and lease agreements

- Ancillary service agreements

- Supervision agreements

In the following sections, we’ll discuss all the above types of healthcare agreements in more detail.

1. Physician employment contracts

A physician employment contract is an agreement between a physician and a hospital, with the physician agreeing to work as an employee of the hospital.

Elements included (and negotiated) in a physician employment contract are:

- Compensation

- Benefits

- Schedule (such as on-call obligations)

- Terms of termination

- Restrictive covenants

A restrictive covenant addresses issues such as, in the event of termination, will the physician be able to continue practicing in the area.

2. Physician recruitment contracts

A physician recruitment contract is related to, but distinct from a physician employment agreement. In recruitment agreements, a hospital or other healthcare provider lays out the terms of recruiting a physician to work for them.

Typically, physician recruitment contracts will specifically stay in compliance with federal Stark laws, which deal with the handling of referrals. If hired, the just-recruited physician will be in a position to accrue federal inpatient and outpatient referrals (designated as health services or “DHS” in Stark).

The proposed financial relationship must stay in compliance with Stark, coming under very strict requirements for both parties.

3. Management services arrangements

Management services agreements are used to outsource the management of any non-medical personnel to a third-party management company. In most cases, this management company is also in charge of the upkeep of the physical offices and equipment.

The following types of workers are placed under the management company:

- Medical practice administrators (who manage various business functions)

- Clerical/secretarial staff

- Bookkeeping professionals

- Collections personnel

- Anyone who does not perform a direct medical function

The management company typically leases or subleases the practice’s medical offices. As part of the lease, the management company keeps the offices in good repair — for example, maintaining office furniture, facilities, and medical equipment. Janitorial and custodial services are also typically included.

4. Medical directorship arrangements

A medical directorship arrangement is a role that a physician may enter into. It’s more closely related to the larger policies and administration of the healthcare provider than a normal physician’s role would be.

Though the director may fulfill a wide variety of tasks, they’re usually involved in policy development, promoting best practices, and providing training.

With a medical directorship, though, comes the need for compliance with Stark Law and Anti-Kickback Statutes. The office of Inspector General (OIG) along with the Department of Justice are taking initiatives to investigate any possible non-compliant arrangements.

The Anti-Kickback Statute forbids medical directors from making payments in the form of remuneration in exchange for referrals or to attract business that is paid for by federally sponsored healthcare programs.

5. Transfer agreements

The next common type of medical contract is a transfer agreement. This is a written agreement between two separate healthcare providers for transferring a patient from one to the other. A fairly straightforward document, a medical transfer agreement is nonetheless a legal document requiring witnesses and signatures and needs to be compliant with specific laws.

In a typical medical transfer agreement, terms (length of care), terms of termination, duties, and insurance information are included. Also, liability issues, billing, governing laws, access to records, and free choice and medical judgment sections are usually included.

6. Technology licensing agreements

Hospitals are the home to some of the world’s most advanced technologies. However, the process of acquiring these technologies usually means entering into a licensing agreement. To understand how best to manage licensing agreements, it is important to understand the legal implications that accompany licensing agreements.

The leading authority on intellectual property and licensing agreements is the World Intellectual Property Organization (WIPO). In their manual “Negotiating Technology Licensing Agreements,” they describe a licensing agreement as a relationship, usually spanning only a specified amount of time, and moving toward the mutual benefit of both parties.

7. Executive compensation and employee benefit arrangements

Executive compensation plans and arrangements include a wide variety of legal, financial, and tax information. An increasingly complex maze of government regulation and market pressures create a wide variety of complications around taxes, bankruptcy, securities, and corporate governance.

Common types of executive compensation and employee benefit types include salary, health coverage, insurance plans, stock options, and bonuses. Several regulatory methods keep executive compensation as fair as possible including extending the vesting period and disclosing salaries.

Keeping the executive compensation and employee benefits in a highly secure location will help greatly with avoiding possible liability issues. In these days, the best and safest option is to store documents in a safe, secure cloud contract repository.

8. Joint venture agreements

Joint venture agreements take place between two or more companies, corporations, or individuals. Usually, they are short-term partnerships that share profits, risks, and assets as the two entities seek mutual profit.

When companies are seeking new technologies or to enter new markets, they often partner up to form a joint venture. Partnership contracts and commercial transactions law govern joint ventures in the United States. Also, they are subject to income tax and in some cases, international trade laws. Hospitals may utilize joint-venture agreements as they seek to expand technologically or strategically.

9. Purchased service agreements

Purchased services agreements are given to any outsourced third party that, instead of working directly for the hospital, works as a non-employee contractor to the hospital or healthcare provider. Many healthcare providers look to purchased service agreements as a way to reduce costs.

For hospitals, these types of agreements generally go into four categories of contractors: clinical, environmental, support services, and financial. According to beckerhospitalreview.com, purchased services “can account for up to 35 percent of a typical U.S. hospital’s operating expenses.”

When managed correctly, purchased service agreements can help hospitals save a great deal of money. Conversely, when poorly managed, they can present a serious risk. The contract manager needs to take great care to secure that the best pricing and make sure all the necessary legal and regulatory requirements are met.

Check out this case study about how a healthcare provider is using contract management software to better manage medical contracts, including purchased services agreements.

10. Under-arrangement agreements

An under-arrangement agreement is similar to a purchased services agreement. Both contract with a third party to provide a service to the hospital, but there are some key differences. There are several criteria for under-arrangement healthcare contracts, firstly, the service provided by the third party under the “under arrangement agreement” is treated and billed like a hospital service.

Then the contracted entity seeks reimbursement, often on a “per-service” basis. The hospital’s agreement with the contracted entity must require the entity to look solely to the hospital for payment. With under-arrangement agreements, compliance with Stark Law is also a crucial factor.

11. Real estate agreements

The reality of providing healthcare services means that legal, medical, and real estate issues are not as distinct as they may seem at first. Rather, they are separated by only fine lines.

Healthcare providers who do not properly manage their practice’s real estate can incur substantial fines. BerkshireHospitalReview.com shares a story on the necessity of keeping hospital real estate in compliance with federal rules and regulations.

“Detroit Medical Center was fined and agreed to pay $30 million to the federal government to settle allegations of potentially improper relationships between the health system and roughly 250 physicians, which again included leases below fair market value.”

Two important pieces of legislation bear on hospital real estate: the Stark Law and the federal Anti-Kickback Statute. Both forbid providers from offering referrals in exchange for some type of business arrangement.

12. Equipment sales and lease agreements

For the specialized equipment that hospitals require, the many benefits of arranging to lease, instead of buying expensive brand-new equipment, can be significant.

For example, some leases of equipment are tax-deductible transactions to the IRS, more flexible, speedy, and easier to manage than loans. See healthlthleadersmedia.com for a more detailed report on leasing medical equipment.

13. Ancillary service agreements

Ancillary agreements can vary in terms of content.

They generally encompass the following categories of medical contracts:

- Escrow agreements

- Documents of transfer

- Post-closing commercial arrangements

14. Supervision agreements

Interns and individuals involved in a residency program require a supervisor as they gain the necessary experience.

Having a supervision agreement is critical because it provides these key benefits:

- Solidifies roles and responsibilities

- Establishes collaborative relationships and boundaries

- Creates a review process

A supervisor agreement is a formal document that provides a backdrop from which to conduct performance reviews.

Data privacy and compliance in healthcare contracting

Data privacy and compliance are important in any sector — but as healthcare providers manage sensitive patient data, they need to be especially careful about the following laws and regulations.

- The Health Insurance Portability and Accountability Act (HIPAA) of 1996 sets national standards for the protection of sensitive patient health information, particularly in regard to how it’s shared.

- The HIPAA Privacy Rule is a key component of HIPAA that directly addresses the protection of patient data. This rule safeguards the privacy of protected health information (PHI), setting limits and conditions on its use and disclosure.

In general, the Privacy Rule prohibits covered entities from disclosing PHI to anyone other than the patient without written permission. This means that healthcare providers and businesses must have appropriate safeguards in place — including modern contract management software.

How to manage medical contracts more securely

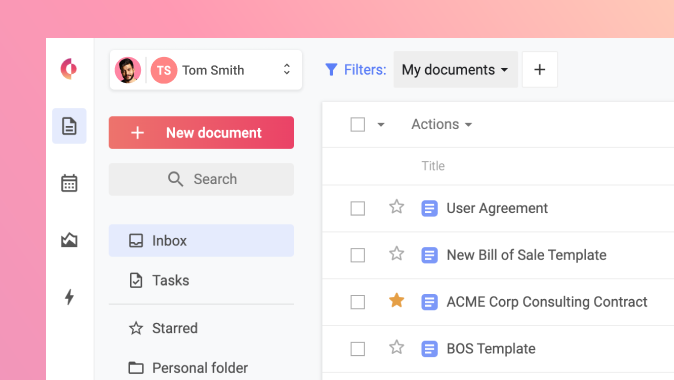

To make handling all types of medical contracts easier, more secure, more simplified, and more intuitive than ever before, many healthcare providers are turning to contract management software. This software makes it easier to handle the whole contract management process, from drafting to signing to storage and search — all in one online document repository.

A contract management tool for healthcare contracting should include:

- Balk-level data security, based on factors such as data encryption (at rest and in transit), SSO and two-factor authentication of users, and external compliance audits of the provider.

- Audit trails, which track each interaction with a document, even after it is signed.

- HIPAA-compliant e-signatures, to facilitate the signing process while staying compliant.

- Features supporting compliance, such as templates, a clause library, and contract approval workflows.

These features all help increase the security of healthcare contract management, while helping safeguard data privacy and keep your organization compliant with evolving regulations.