Legal and Risk: What You Need to Know

This is the first in a four-part series for Legal teams on how to assure compliance; manage risk now and in the future; and enable growth. Read Part Two, Part Three, and Part Four.

It’s no secret. Organizations are dealing with a challenging business climate. They lose millions due to lack of visibility and pay hefty fines resulting from the inability to keep up with an ever-increasing pace of business. Rising levels of uncertainty within our global economy have resulted in an alarming amount of potential pitfalls for incumbents and newcomers alike. This means risk management, current and future, has never been more of a top priority. The good news, In-house Counsel has a secret weapon—contracts.

Touching every business process and every department, contracts, and the processes surrounding them, are the critical lynchpin when it comes to Legal’s ability to plan for, mitigate, and manage risk.

This four-part series should be required reading for every Legal department and every contract practitioner’s desk. With actionable insights— to identify, review, analyze, evaluate, mitigate, manage, neutralize, and eliminate risk using contracts—it’s a guide for how Legal teams can accomplish their big three: assure compliance; manage risk now and in the future; and enable growth through faster processes allowing other departments, and the overall business, to move fast without creating risk.

Legal and Risk

The role of In-house Counsel has changed dramatically, especially in forward-thinking organizations. The Legal department is now a key partner in business planning and performance, going far beyond the pure “protector” role of the past, now involved in helping business operators evaluate and address risk. This makes business operations more agile, resilient, and responsive to change.

According to the 2016 HBR Law Department Survey, the top three methods to manage increasing legal demands are 1) increasing the use of technology; 2) reengineering work processes; and 3) automation of routine tasks. All of these involve enhancements to process and technology. The same principles hold true when it comes to risk and compliance.

Risk and compliance have been “managed” for a long time. Organizations have developed a slew of departments and programs—performance management programs, risk management programs, compliance programs, corporate social responsibility programs, and so on. Unfortunately, these departments and programs are often siloed and ineffective, resulting in counterproductive objectives and sub-optimal outcomes, including drawbacks:

- High costs

- Lack of visibility into risks

- Inability to address third-party risks

- Inability or difficulty measuring risk-adjusted performance

- Negative surprises

There’s another way.

Theodore Roosevelt said,

“Risk is like fire: If controlled, it will help you; if uncontrolled, it will rise up and destroy you.”

The “department of no” can be the “department of yes,” enabling others and driving business forward. All that’s needed is a modern approach.

A new, old method

Establishing an approach that ensures the right people get the appropriate and correct information at the right times, that the right objectives are established, and that the right actions and controls necessary to address uncertainty and act with integrity are put in place.

OCEG has an interesting take on next steps. Principled Performance is a method they define as “an approach to business that helps organizations reliably achieve objectives, address uncertainty, and act with integrity.” Sounds like In-house Counsel in a nutshell, doesn’t it?

Here’s what that looks like:

GRC, sparked by the famous ‘Sarbanes-Oxley Act (SOX)’ highlights the three stages or areas of focus when it comes to comprehensive risk management.

This three-pronged approach’s ultimate goal is to create a comprehensive, integrated method of dealing with risk. Contract management is how Legal achieves it.

Next week, we’ll discuss how to achieve risk and compliance maturity through contracts.

Want to see how you can reduce your risk?

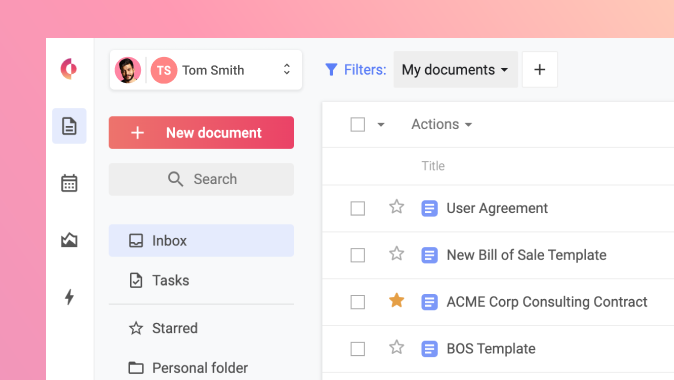

Concord’s mission is to help companies achieve scalability and efficiency by automating their most central process, contracts. The cloud-based solution enables over 400,000 users around the globe to create, collaborate, sign, store, and manage their agreements all in one place. Founded in 2014 and headquartered in San Francisco, Concord is built by business for business.