Top 4 Contract Risks and How to Mitigate Them

The average company has 20,000-40,000 contracts. How do you make sure contract risks are properly safeguarded?

Modern businesses manage thousands of contracts. From vendor relationships to sales agreements, there is no shortage of variety, types, and lengths of contracts for enterprise businesses.

As the amount of contracts continues to grow, there are numerous uncertainties associated with making and handling them. Here are the top four contract risks and how to mitigate them.

Top contractual risks

The top contract risks are:

- Insufficient speed during the contract process

- Poor visibility into contracts and inappropriate access rights

- Lack of compliance

- Contract management process inefficiencies

In the following sections, we will discuss the contractual risks in more detail, together with the ways they can be mitigated.

Contract risk #1: insufficient speed

One of the most significant contract risks is the lack of speed during the contract process. It isn’t uncommon for it to take weeks or even months to create a contract. Not to mention the time the legal team spends honing proper language or creating templates.

The longer it takes to create and finalize a contract, the more it slows down the entire business process. Contract creation, negotiation, and approval all take much longer than necessary, which can result in missed opportunities, deadlines, and goals.

Time-to-signature is an important number, especially for sales teams. Goals shouldn’t be missed simply because the contract process isn’t fast enough.

Risk #1 mitigation

One of the easiest ways to reduce this contract risk is by using a contract lifecycle management platform. A contract management tool helps automate the whole contract process, which greatly increases the speed of finalizing agreements.

How does a CLM tool help automate the contract lifecycle for increased speed?

- Contract templates: By utilizing ready-made templates, you can create new contracts in a fraction of the time it would take to draft from scratch.

- Clause library: Having a library of pre-approved clauses allows you to quickly insert language into new or existing contracts, eliminating the need for lengthy legal reviews for each one.

- Online contract negotiation: This feature streamlines back-and-forths by allowing all parties to negotiate terms directly within the document, reducing the time spent on email exchanges or in-person meetings.

- Approval workflows: Automated approval workflows send the contract to the right stakeholders at the right time, speeding up the internal review process and reducing the chance of delays.

- E-signatures: Electronic signatures enable quick and secure contract signing, eliminating the need for physical signatures and the associated shipping or meeting times.

Contract risk #2: visibility and access rights

Visibility can be a major blockade in contract creation. Yet this goes beyond just creation. Truly, having the right visibility into a contract helps the entire contract lifecycle.

Without visibility into all of a company’s agreements, it’s easy to miss crucial deadlines such as contract renewals which can lead to unintended auto-renewals, lapses in service, or missed opportunities to renegotiate terms. This can lead to financial losses for a business.

Not having the proper access rights to contracts can be problematic, particularly for businesses that manage a large number of agreements. This lack of access can make it difficult for the team members to keep track of their contracts throughout the contract lifecycle process.

Ensuring that the appropriate team members have access to the agreements and providing the necessary permissions is key to preventing this contractual risk. The legal team can quickly find, review, and approve a contract when it’s time for renewals. This approach is far preferable to cutting the legal team out entirely.

Visibility is also critical in high-growth business phases when contract management can be more complex due to a large number of new contracts.

Risk #2 mitigation

Companies should establish clear visibility and access rights to mitigate this contract risk.

The traditional way of minimizing this risk is to designate a dedicated team or individual to be responsible for maintaining a comprehensive contract repository. This includes keeping a detailed spreadsheet or database with key dates, parties involved, and other essential terms. Regular meetings can be scheduled to review upcoming deadlines and discuss needed actions.

However, this approach is time-consuming and leaves room for human error, which can be costly.

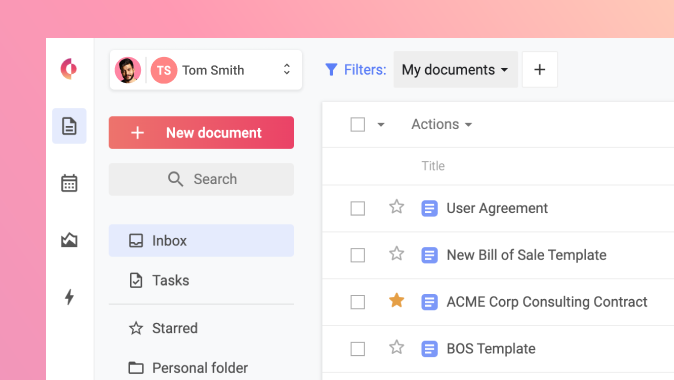

A contract management platform provides a far more efficient solution for visibility and access rights. These platforms offer a centralized cloud repository where all contracts are stored securely. They can provide visibility into contracts, allowing users to view and approve them promptly to maintain compliance.

With built-in search capabilities, team members can quickly find contracts, see upcoming deadlines, and receive automated alerts for crucial dates. Additionally, CLM tools make contract management reporting and analytics much easier.

In a contract management platform, you can also set permission levels, ensuring that only authorized individuals can access specific contracts. This makes it easier for the right team members to take timely action, reducing risks and enhancing contract management across its lifecycle.

A solid approach to contract management involves being aware of and mitigating any contract risks that come along with the process. Establishing efficient processes, such as communication across the company, workflows, and written strategies, can help prevent inconsistencies and minimize contract risks.

Contract risk #3: compliance

Companies have the challenge of navigating regulations, requirements, and rules, along with industry expectations and business process changes. For any enterprise business, but especially a global company, internal and supplier contract risks need to be evaluated, analyzed, and eliminated.

Noncompliance can lead to costly fines or breaches of contracts that can break trust and damage relationships. Obviously, contract compliance is more than just legal rules to adhere to. It’s a core function of maintaining or increasing savings, a way to establish a good reputation and ensure a well-respected brand.

Additionally, the ripple effects of noncompliance can extend far beyond financial penalties. It can trigger audits or increased scrutiny from regulatory bodies, which can divert valuable time and resources away from core business functions.

In a worst-case scenario, a high-profile case of noncompliance can severely tarnish a company’s image, resulting in lost business and a long road to reputation recovery. Therefore, ensuring compliance is not just a legal necessity but a strategic imperative for long-term business sustainability.

Risk #3 mitigation

A good way to ensure compliance is through proper visibility into agreements. Contracts must be viewed and approved by the necessary parties to maintain compliance. It is also important to come up with an approach for monitoring any modifications in regulations and for understanding how to comply with these new regulations in the future. Analytics and technology should be used to assess and mitigate contract risk.

Even with completely automated systems, laws and rules still change. It’s important for all teams, especially Legal, to keep up with current regulations to ensure that companies are working within the correct local and global rules. Establishing compliance ownership clarifies processes and ensures that all parties know what is expected of them.

Be sure to identify:

- Who is responsible for compliance

- What is their objective view of the company

- How compliance will be enforced

- Ways that compliance and performance are related

- What measures are in place to keep employees aligned

With these key factors identified, managing risk even in a changing landscape will be much simpler.

Contract risk #4: process inefficiencies

Lack of consistency across a company’s documents and processes can lead to many contractual risks. For example, a few are unpredictable pricing, rogue spending, compliance issues, and much more.

Further compounding the problem is the risk of human error. Inconsistent or inefficient processes often require manual intervention, which increases the likelihood of mistakes. These errors, whether they’re in data entry, approval flows, or document handling, can have serious consequences ranging from contractual disputes to compliance violations.

In a business landscape that increasingly values speed and accuracy, these inefficiencies and errors not only present immediate risks but also hamper a company’s competitive edge.

Thus, addressing process inefficiencies is crucial not just for risk mitigation but also for maintaining a strong market position.

Risk #4 mitigation

Successful businesses have processes outlined and workflows in place to make sure these inconsistencies don’t happen in their organization.

One key process that can be streamlined is contract approval workflows. These workflows should be standardized and documented to ensure that all necessary approvals are obtained before a contract is executed.

This can prevent delays and misunderstandings, and also help to reduce the risk of contract disputes. Contract management software can automate the approval process, allowing managers to easily track the status of contracts and ensure that they are being reviewed and approved in a timely manner.

Another way to improve process inefficiencies is to create a contract template library. This library should include templates for different types of contracts, such as service agreements, nondisclosure agreements, and employment contracts.

The templates should be standardized and pre-approved by legal, ensuring consistency across all contracts. This can help reduce the time and effort required to create new contracts and improve the accuracy of the information contained in the contracts.

A legal clause library is another contract management software feature that can be used to mitigate contract process inefficiencies. Such a library contains pre-approved legal clauses that can be added to contracts as needed.

It helps ensure that all contracts are compliant with relevant laws and regulations, reducing the risk of legal disputes. Additionally, a clause library can save time and effort by eliminating the need for legal teams to review and approve individual clauses for each contract

Finally, clear communication across a company and a well-planned, written strategy are necessary for any organization to reinforce efficient processes.

The best solution for mitigating contract risks

Practical contract management involves being aware of and mitigating any contract risks that come along with the process. Ensuring contracts are optimized by implementing a contract lifecycle management platform is the first step in lowering risk and simplifying contracts. `

For mitigating contract risks, choose a contract management platform with the following features:

- Contract template library

- Clause library

- Contract approval workflows

- Cloud contract repository