The 7 Stages of Contract Management and the Contract Lifecycle

Table of contents

- What are the 7 stages of contract management?

- Stage 1: Initiation

- Stage 2: Drafting

- Stage 3: Approval

- Stage 4: Negotiation

- Stage 5: Signature

- Stage 6: Filing

- Stage 7: Data analysis

- Moving forward in contract management

-

About Concord

Effortless contract management, from drafting to e-signing and beyond. Book a live demo to see Concord in action.

Request demo

Each of the seven stages of contract management plays a pivotal role, ensuring contracts are not just legally compliant but also aligned with your business’s goals and objectives. In all these ways, a well-executed contract management strategy leads to stronger business relationships and improved performance outcomes.

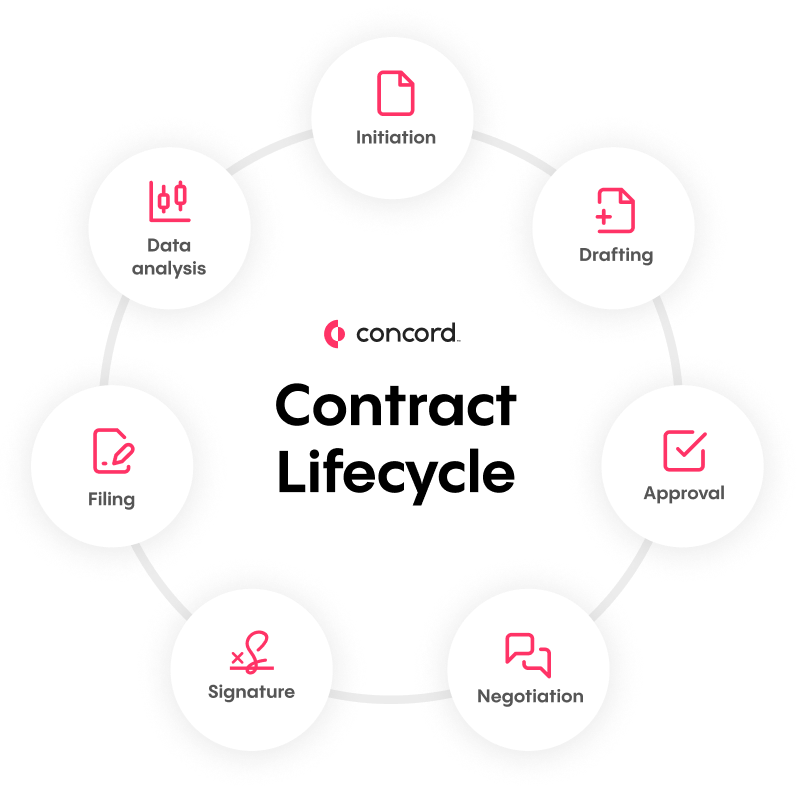

What are the 7 stages of contract management?

The seven stages of contract management are as follows:

- Initiation

- Drafting

- Approval

- Negotiation

- Signature

- Filing

- Data analysis

Stage 1: Initiation

Contracts are legally binding documents that should not be approached lightly. Therefore, it’s important to be organized and prepared with the right resources.

Properly identifying the needs, reasons, and ultimate goals that require a contract makes any decisions down the line much easier.

Goals of the initiation stage:

- Identify contract needs and stakeholders

- Establish objectives and success criteria

- Assess potential risks and constraints

For example, the terms of agreement within a contract should address what happens if the client files for bankruptcy, goes out of business, or sells the company, along with any other contingencies that may arise.

Another example is a contract outlining pricing terms for customers. One goal of this document is to financially protect the business in any scenario, and ensure payment once the tasks outlined in an agreement are complete.

Good contract management ensures that even if a business relationship is strong, each side obtains exactly what is in the contract.

Once we establish the reasons for creating a contract, it’s time to begin drafting the contract.

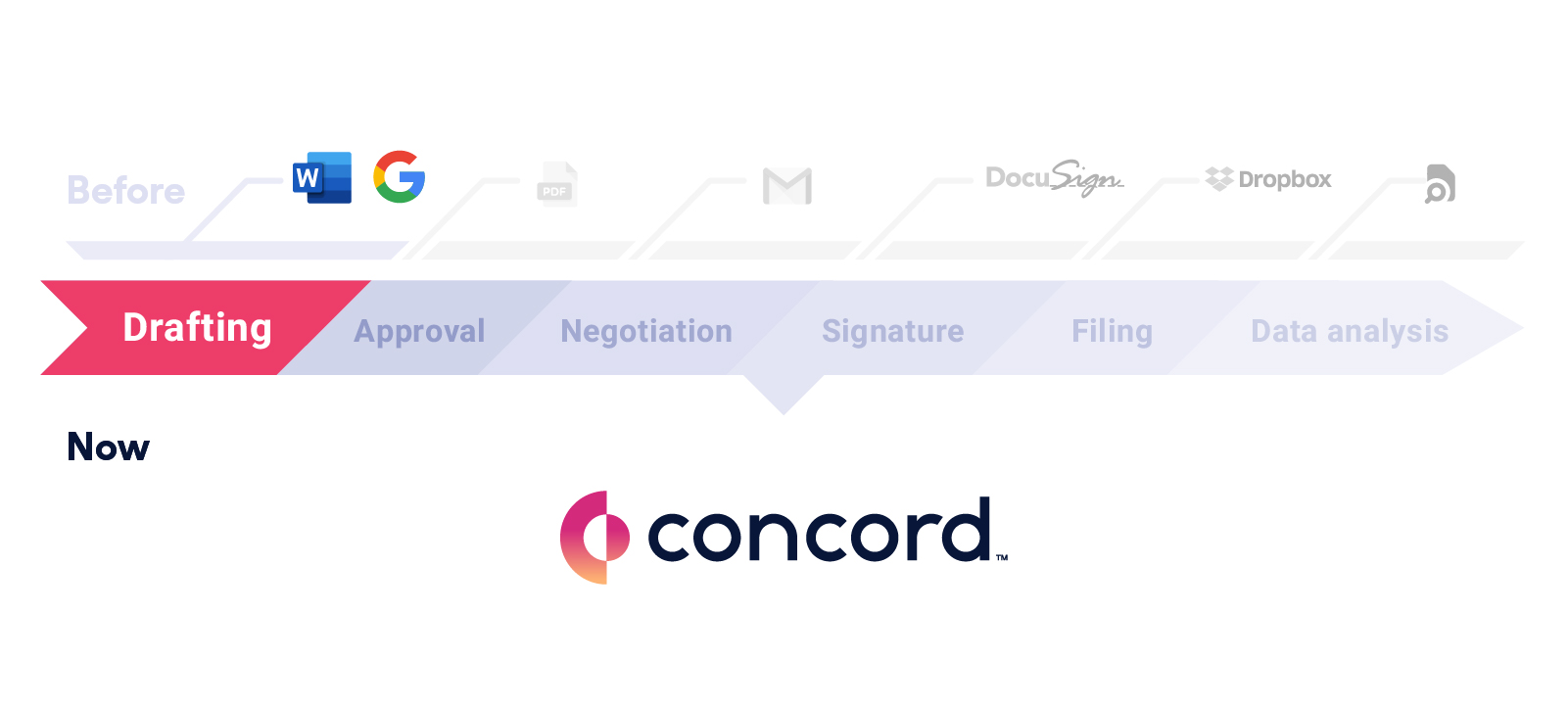

Stage 2: Drafting

Goals of the drafting stage:

- Create a clear, comprehensive contract draft

- Check for legal compliance and alignment with organizational policies

- Incorporate stakeholder inputs and feedback

Consulting with in-house counsel or an attorney is wise, especially if there are any uncertainties. Better yet, use a pre-set template drafted by your legal team to ensure all the information is up-to-date and all required clauses and terms are automatically included.

When drafting or authoring the terms of the contract, it’s important to pay attention to specific wording. Any ambiguity leaves contracts up for interpretation, even down to a comma. State and country laws also need to be taken into consideration. This is especially true if the two parties are in different locations.

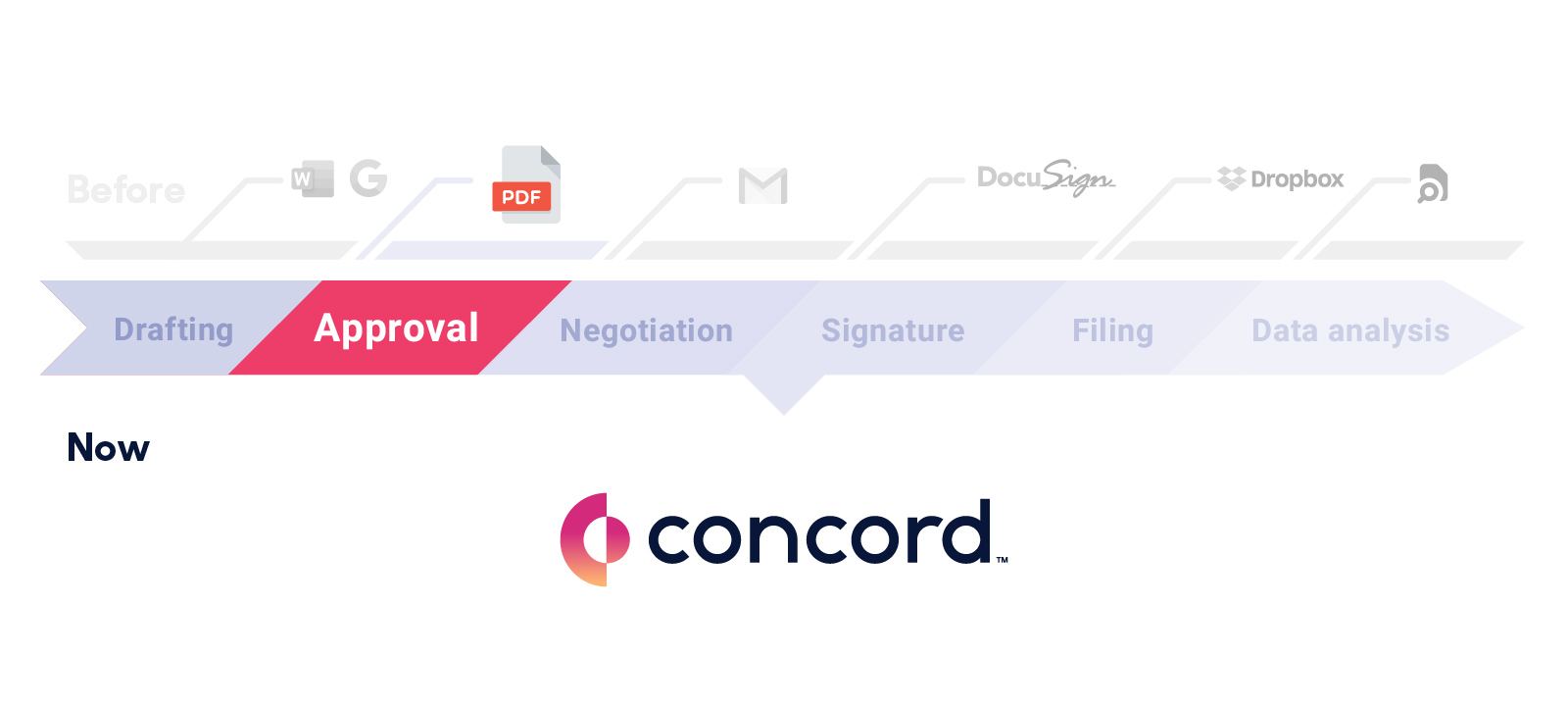

Stage 3: Approval

In companies that need manager approval or have audit procedures, all requirements for approval need to be met before finalizing the deal.

Goals of the approval stage:

- Secure necessary contract approvals from all relevant parties

- Ensure the contract meets organizational standards

- Resolve any disagreements or issues before proceeding

For example, a company needs to meet procurement policies prior to contract approval. In contract management software, this is as simple as setting up an approval workflow. Simply put, whoever needs to approve the contract receives a notification and can view, edit, and comment on the contract in real-time.

Stage 4: Negotiation

Goals of the negotiation stage:

- Achieve a mutually beneficial agreement

- Clarify terms and conditions to avoid future disputes

- Balance organizational interests with counterpart’s needs

No matter how much research, planning, and preparation goes into the first draft of a contract, a negotiation usually follows.

Contract negotiation should begin with transparency and trust. Anticipating and researching the other party’s needs before the conversation simplifies the process. Furthermore, it creates a strong foundation for a lasting relationship.

As redlining begins, it’s easiest to use contract management software so both parties can view the working document to make changes and collaborate in real time.

Email and offline documents can be confusing and cause costly mistakes. A single source of truth for conversations and contracts will result in quicker negotiations and a contract that provides visibility for both sides.

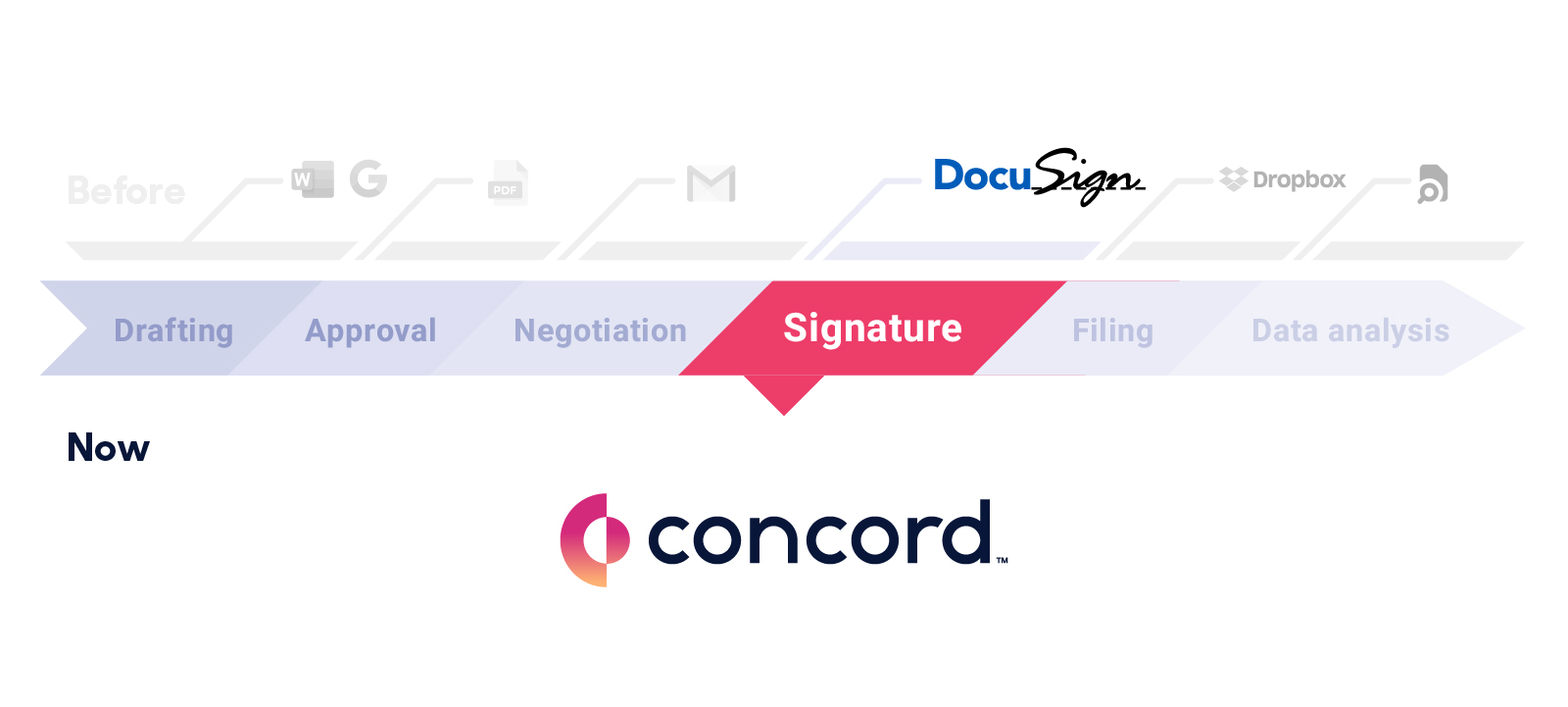

Stage 5: Signature

Goals of the signing stage:

- Obtain official signatures from all parties

- Verify that the contract is legally binding

- Confirm understanding and agreement of the contract terms

The signing should be the simplest part of a contract. Both parties agree the wording is exact, and the next step is simply making it official.

However, many businesses make agreements across the country or even the globe, and getting signatures isn’t as straightforward as meeting in person. Especially if deadlines are tight or time zones are incompatible, overnight mail or even email may not be the best way to get signatures faster.

A legally binding electronic signature can solve all these problems, allowing you to move faster. More importantly, it accelerates signatures and revenue.

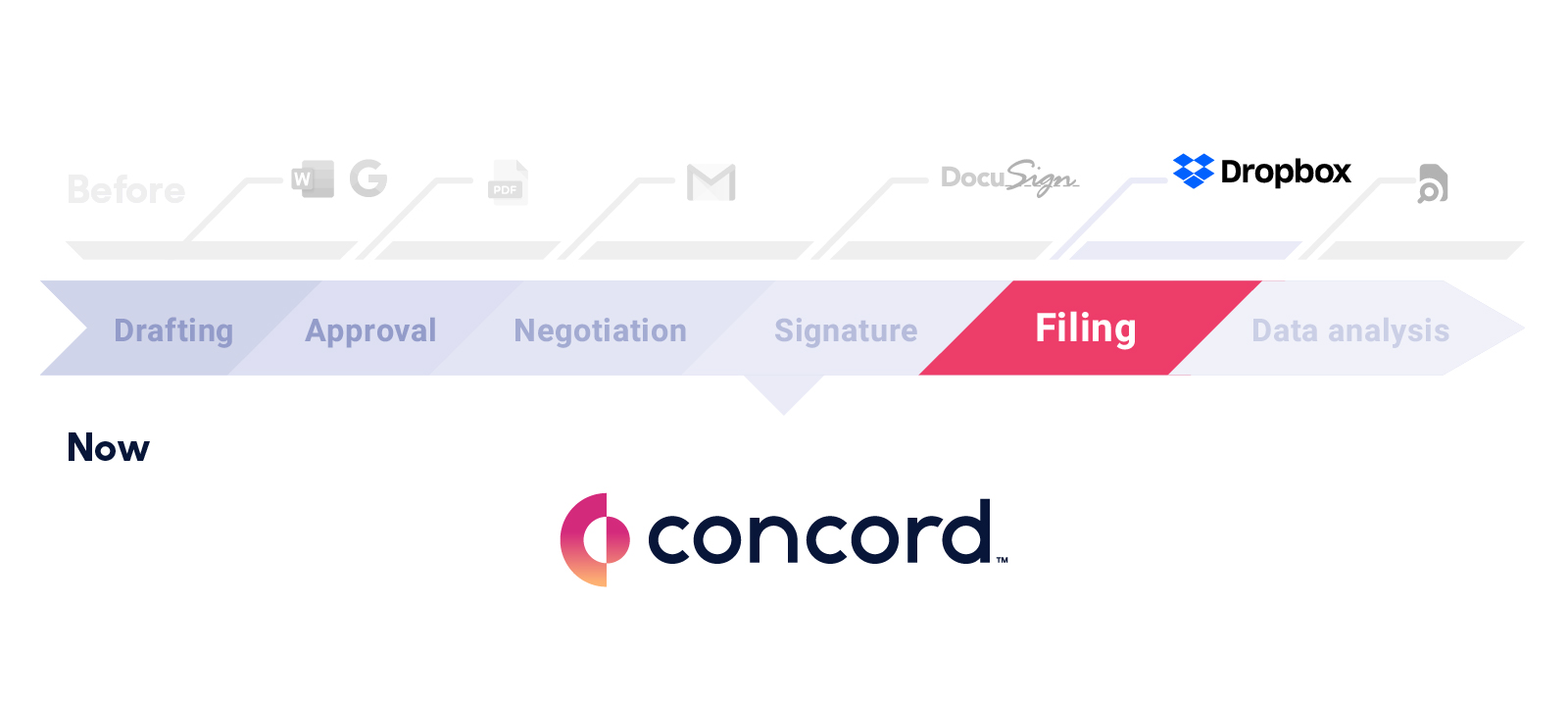

Stage 6: Filing

Goals of the filing stage:

- Securely store the contract for easy retrieval

- Keep accurate records of any amendments or modifications

- Maintain organization and accessibility for future reference

Contracts are rarely stagnant. Revisions and amendments are a common part of the contract lifecycle. Tracking changes and the effects for each party can be confusing, unfortunately.

Moreover, this is another reason to implement a reliable process, such as contract management software, to easily record edits and add amendments. It’s important to stay ahead of the changes. Additionally, make sure both parties are fully aware and in agreement on any revisions.

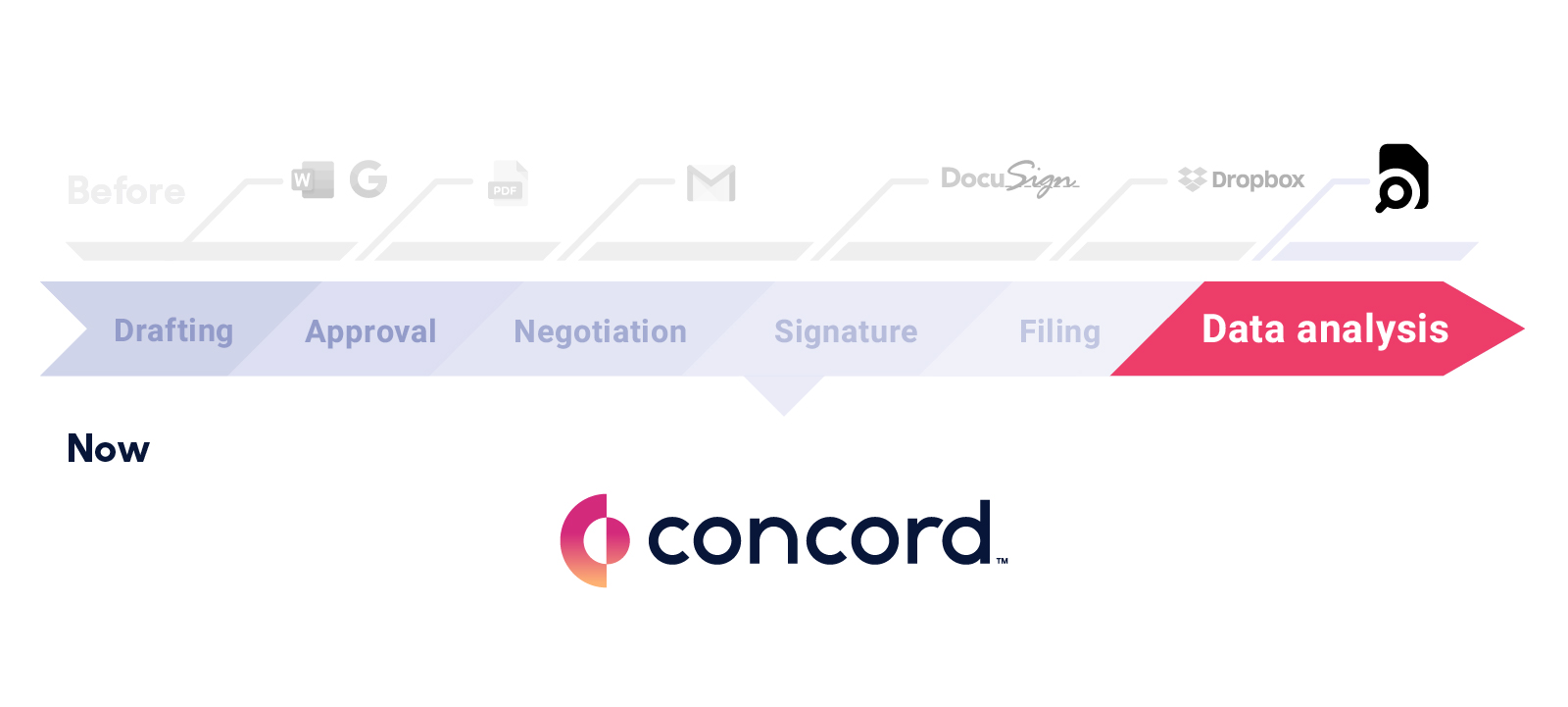

Stage 7: Data analysis

Finally, contract management doesn’t stop once there is a signed contract. In particular, performing regular audits ensures all parties meet contractual obligations and realize value.

Goals of the data analysis stage:

- Monitor contract performance against goals

- Identify areas for improvement or renegotiation

- Leverage insights to inform future contract strategies

Alerts should be set for contract renewals and other deadlines. Missed renewals mean lost opportunities to continue a relationship, and most importantly for a company, lost revenue. Being aware and making contact well before the renewal time shows reliability and care for the relationship. Additionally, this effort will continue to build trust and loyalty.

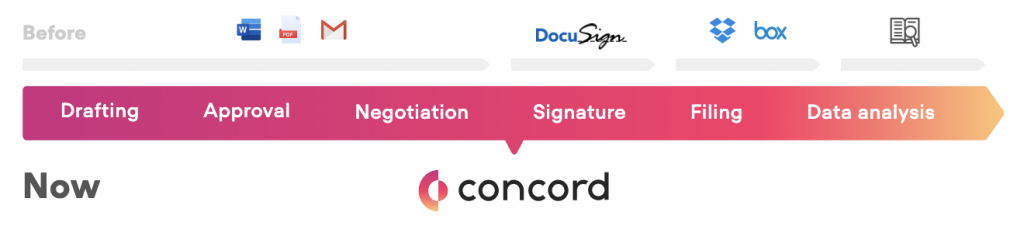

Moving forward in contract management

Contract management is often thought of as a time-consuming task, however, with contract management software it can be automated to increase efficiency and save time. This way, it has the potential to be one of the most lucrative areas for building business relationships and generating revenue.

A contract management platform simplifies contract management processes by:

- Helping avoid compliance issues with contract templates and approval workflows

- Streamlining contract negotiations with online redlining and commenting

- Delivering more revenue (and faster) with online e-signatures, and

- Tracking deadlines, helping organizations avoid fees and missed renewal opportunities

Forward-thinking companies are turning to contract management platforms to reduce costs, mitigate risks, and increase profitability.