Understanding the 4 main types of procurement contracts

Table of contents

- What is a procurement contract?

- What is included in a procurement contract?

- Types of procurement contracts

- Type 1: Fixed-price procurement contracts

- Type 2: Cost reimbursable contracts

- Type 3: Time and materials contracts

- Type 4: Purchase orders

- The importance of procurement contracts

- Streamlining the procurement contract process

-

About Concord

Effortless contract management, from drafting to e-signing and beyond. Book a live demo to see Concord in action.

Request demo

Whether you’re new to procurement or are a purchase-order veteran, you may never have had to draft a procurement contract from scratch. This can lead to frustration when you need to amend or rewrite a contract for products or services, and aren’t quite sure what language is necessary to include, and what can be safely removed.

That’s why we’ve put together this walkthrough of procurement agreements basics. Here, we’ll explain what a procurement contract is, what it’s for, and what clauses it needs to include. We’ll also explore different types of procurement agreements, and see how effective procurement contract management can streamline the process of drafting and negotiating them — for example, through the use of procurement automation. Let’s dive right in!

What is a procurement contract?

A procurement contract is a legally binding agreement between a buyer and a supplier, specifying the terms under which the supplier will provide goods or services to the buyer. It serves as a formal document that outlines all the conditions, terms, responsibilities, and specifications involved in a transaction.

Procurement agreements play a critical role in any business transaction. They formalize the relationship between the buyer and the supplier. They also set expectations, define roles and responsibilities, and provide a legal framework for resolving disputes.

What is included in a procurement contract?

A procurement agreement typically includes all the following elements:

- Description of the products or services involved

- Payment terms and pricing structure

- Duration of the contract

- Responsibilities of both parties

- Termination clauses

Let’s delve into each of these components in more detail.

Description of products or services

A procurement agreement should clearly describe the goods or services that are being exchanged. The contract should outline specifics such as quantities, quality, and delivery schedules, to avoid misunderstandings.

Payment terms and pricing structure

The contract needs to outline terms for payment. For example, it might specify upfront payments, milestone payments, or periodic billing. It may also specify a pricing structure that’s fixed, variable, or a mix of both, depending on the nature of the procurement.

Duration of the contract

Like every formal agreement, a procurement contract has to specify its start date and end date, so all parties know what time period it applies to. Knowing the contract’s duration helps both parties manage their schedules and expectations.

Responsibilities of both parties

The contract should explicitly state what each party is obligated to do. In the world of procurement, this might include specifications for quality control and delivery timelines, as well as any other agreed-upon responsibilities.

Termination clauses

The contract needs to clearly define the conditions under which it can be terminated. It’s also important to outline the consequences of breaches by either party.

Types of procurement contracts

It’s helpful to have a variety of different types of procurement contracts available, so you can tailor them to the needs of each supplier relationship.

Here are three of the most common types of procurement agreements and their subtypes:

- Fixed-price (FFP) contracts

- Firm fixed-price contract (FFP)

- Fixed-price incentive fee contract (FPIF)

- Fixed-price with economic price adjustment contracts (FP-EPA)

- Cost reimbursable contracts

- Cost plus fixed fee contract (CPFF)

- Cost plus incentive fee contract (CPIF)

- Cost plus award fee (CPAF)

- Cost plus percentage of cost (CPPC)

- Time and material contracts

- Purchase orders

In the following sections, we’ll discuss the different types of procurement contracts in more detail.

Type 1: Fixed-price procurement contracts

Firm Fixed Price (FFP) contracts are straightforward, but can expose your organization to financial risk if the costs aren’t carefully calculated. Alternatively, specifying a fixed pricing structure with economic price adjustment allows some flexibility for market fluctuations.

These types of procurement contracts are best used when an individual knows exactly what the scope of work is. A fixed-price contract, also called a lump sum contract, is ideal for keeping costs low when the project scope is predictable.

For example, if a company requires services from a vendor and the scope of work is clearly defined, there is a cost risk. This contract ensures the company will pay only a specified amount of money for the work required.

Here are some other benefits of using this type of contract:

- Once both parties have signed the contract, the seller is required to perform the service within the stated timeframe. This will go a long way in ensuring your project is completed on time.

- It takes away the guesswork about price. For instance, if you hire a contractor to complete a project on a fixed-price contract, they are required to do the work for the amount in the contract. This makes controlling costs much easier.

- The seller assumes most of the risk because he has legally committed to project specifications.

This type of contract is best for outsourcing or turnkey projects.

Fixed-price contract subtypes

Within fixed-price contracts, there are three further subtypes. Again, each one is ideally suited for specific scenarios.

Here’s a brief overview of each of the subtypes.

- The firm fixed-price contract (FFP). This is the simplest of all the fixed-price contracts. The selling price or fee is fixed, as is the timeframe. For example, the contract may state that the seller must complete the job for the price of $10,000 by the end of the month. If the seller makes a mistake or does something to cause an increase in cost, he will be responsible for it and the price will remain at $10,000.

- This type of contract works when the scope of the work is outlined in meticulous detail. That’s why government offices often prefer to use it. This is the easiest type of contract for procurement professionals to use because it makes it straightforward to take bids and evaluate them together.

- The fixed-price incentive fee contract (FPIF). This type of contract includes everything the FFP contract does. However, it adds a monetary incentive for the seller to do an even better job, or stay ahead of schedule. For instance, the contract includes a financial incentive if the seller finishes the job on time or early, at or below the bid price, or performs in an exemplary manner.

- This type of contract is well suited to providing the incentive necessary to ensure the project is done on time and at or below cost.

- Fixed-price with economic price adjustment contracts (FP-EPA). This is the type of contract to use if the project is expected to last a long period of time. This is because it protects the seller from inflation. For example, businesses can include a clause that gives the contractor a specific percentage increase after a predetermined period of time. Many organizations base this percentage on the Consumer Price Index.

Possible issues with a fixed-price contract

Despite all of the benefits of a fixed-price contract, there are some downsides that businesses need to take into account.

Here are a few things to consider when using fixed-priced contracts:

- The scope of work must be perfectly defined when the contract is signed. If the scope is left ambiguous in any way, the seller can attempt to ask for more money. This is especially true if it is perceived that scope has changed in any way. These types of oversights can easily cause a project to go over budget and should be watched out for.

- Some contractors may submit a low bid in order to be awarded the contract, and then add scope to raise the price. Avoid this by paying close attention to any changes made by the contractor to the scope of the project.

Type 2: Cost reimbursable contracts

Another frequently used contract type is the cost reimbursable contract. If the scope of a project is uncertain or likely to change, this type of contract can be great for keeping on schedule and budget.

The basic premise of the contract is that the seller is reimbursed for costs when his work is completed. Furthermore, they also earn a fee for their work. Businesses will have some flexibility in the contract in regards to establishing the “fee” portion of the contract.

For example, the fee can be based on how well the seller meets or exceeds the objectives of the project. Further, it could encompass how close to the timeline they complete the job. Finally, how well the contractor is able to stay at or under budget may matter.

With cost reimbursable contracts, sellers may try to account for scope creep as a way to anticipate the elevating costs. One potential method to avoid scope creep is to cap the potential fee given to the contractor.

Cost reimbursable contract subtypes

As with the fixed-price contract, there are variations for a reimbursable procurement contract.

The four types that businesses typically choose from are:

- Cost plus fixed fee contract (CPFF). If the project is high risk and there are fears that the procuring organization will not be able to attract bidders, this type of contract is an ideal choice. With it, the seller is protected from risks because the procuring organization will carry them. The contract should include a clause that pays the seller for the costs they incur. It should also include a fee that is not based on this performance. For example, the contractor will be paid his costs, plus a $10,000 fee.

- Cost plus incentive fee contract (CPIF). In this type of contract, the procuring organization will also assume the risk. Fortunately, that risk will be lower because the contractor will have an added incentive. The contractor will be reimbursed for their costs, plus an incentive fee that is based on the job performance. Incentive fees are a predetermined percentage of the savings arising from the seller’s performance. This fee is usually split between the buyer and seller.

- Cost plus award fee (CPAF). While the incentive fee is based on a predetermined percentage of savings, an award is different. Awards are subjective and based on how well the buyer thinks the seller met his performance objectives. Since the award is subjective, it is not open to appeal. When creating the contract, use specific language. It should state the seller may be given an award of up to a dollar amount if they meet or exceed requirements stipulated in the contract.

- Cost plus percentage of cost (CPPC). A CPPC contract pays the seller all costs, plus a percentage of those costs as an added profit. Be careful with this type of contract because it provides an incentive for some sellers to inflate their costs in order to receive a bigger profit.

Type 3: Time and materials contracts

This type of contract is often used when it’s difficult to estimate the extent of the project. It specifies that payments will be calculated based on time and resources used to complete the project.

The time and materials contract form is best when the seller is offering labor and there is evenly distributed risk. This type of contract is typically used to hire an expert or other outside vendors.

In it, you will need to list the desired qualifications or experience. Then, the seller will submit an hourly rate as a bid. Be sure to set a limit or you could quickly find yourself over budget.

Type 4: Purchase orders

What is one of the most common documents in the procurement department? Purchase orders are used for organizations to define their relationship with sellers. Therefore, they act much like a procurement contract.

When a company wishes to request an order for goods or services, it sends a purchase order to sellers. Next, let’s look at the different parts of a purchase order.

Purchase order basics

The form includes the item type, number of items, and a mutually agreed price. As with fixed-price procurement contracts, the more specific a purchase order can be, the better. Further, buyers should include exhaustive details in the document for more efficient and beneficial purchase orders.

When a seller, supplier, vendor, and so forth, accepts a purchase order, it acts as a contract. They enter into a legally binding contract between themselves and the buyer. It is for this reason that the buyer should always use explicitly clear language to communicate with the seller.

Doing so may present more work upfront. However, it carries the added benefit of ensuring that there is no confusion when the purchase order is received and carried out.

An added benefit of purchase orders is that in the event the buyer was to refuse payment, the seller would be protected because the buyer is bound by the terms of the order to pay the agreed-upon price.

The importance of procurement contracts

Procurement contracts are crucial in defining the relationships between buyers and suppliers. They lay the groundwork for expectations, deliverables, and responsibilities. Managing these contracts properly can bring numerous benefits, while failing to do so can lead to significant risks.

What are the benefits of managing procurement contracts properly?

The benefits of managing procurement contracts properly are as follows:

- Streamlining procurement processes: Properly managed procurement agreements standardize the terms and conditions across multiple transactions, simplifying approval workflows and compliance checks.

- Ensuring a clear understanding between parties: A well-crafted and managed procurement contract ensures that both parties are on the same page regarding the scope of work, deliverables, timelines, and other key terms.

- Protection in the event of a dispute: In case of disagreements or conflicts, a contract spells out how disputes are to be handled, what constitutes a breach of contract, and what penalties or remedies are available to the aggrieved party.

What are the risks of not managing procurement agreements properly?

The risks of not managing procurement contracts properly are as follows:

- Possible financial losses: Poorly managed contracts can result in significant financial losses for one or both parties. For example, ambiguous language about payment terms or deliverables can cause disputes that are costly to resolve, and also delay the project.

- Damage to business relationships: A poorly managed contract can lead to dissatisfaction, mistrust, and tension between the buyer and the supplier. This damages long-term business relationships and may prevent future collaborations.

- Legal disputes: Ambiguities or omissions in the contract can lead to misunderstandings that might require legal intervention to resolve. Legal disputes are not only expensive but also time-consuming, and can damage your company’s reputation.

Streamlining the procurement contract process

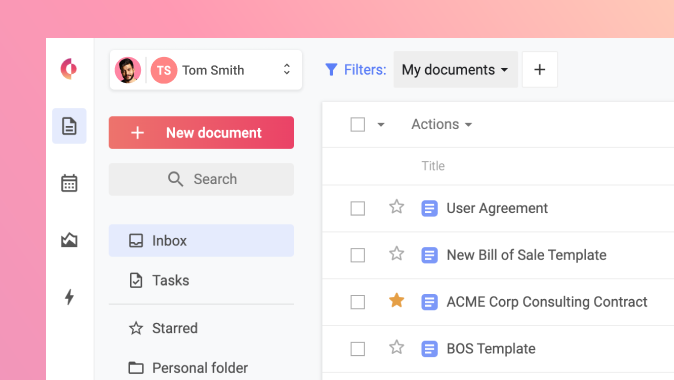

If you’re spending a lot of time juggling procurement contracts on an individual basis, it’s probably time to invest in a comprehensive contract management strategy. Contract lifecycle management (CLM) software can help, by serving as an end-to-end hub for drafting, negotiating, e-signing, storage, and deadline tracking.

In particular, CLM software can streamline the process of procurement contract negotiation. Instead of sending contract drafts back and forth as email attachments, parties can redline changes and respond to comments inside the same shared document, in real time. This can reduce negotiation times from weeks to days – or sometimes even hours.

It’s also helpful to have a library of contract templates, covering all the contract types outlined in the section above. You can jumpstart your contract library with sample agreements from Concord’s template center, which offers a wide range of basic contracts you can customize to suit the needs of each supplier relationship.